Services & Fees

Financial Planning, Retirement Tax Strategist & Investment Management — All for a Flat Fee.

Our flat-fee engagement includes the following services:

Tax-Efficient Investment Management

Retirement Date Projections

Optimize your Savings Strategy

Retirement Withdrawal Strategy

Roth Conversion Strategy

Social Security Claiming Strategy

Goal Setting & Tracking

Account Consolidation & Simplification

Establishing a Budget & Spending Parameters

Debt Management & Analysis

Employee Benefit Selection

New Home Purchase & Sale Decisions

Life & Disability Insurance Needs Analysis

Property & Casualty Coverage Review

Estate & Beneficiary Summary

Tax Projections & Withholding Strategies

Cash Management Systems

College Funding Plan

Tax Efficient Charitable Gifting

Pension Payment Decisions

Our flat-fee is $3,750 per quarter, billed in arrears.

Our fee includes Investment Management

Your Trusted Partner

Once we deliver your financial plan, we continue our engagement with semi-annual meetings — helping you manage all areas of your financial life: Ongoing Financial Planning, Annual Tax Planning, Annual Cashflow Planning, Goal Tracking, Ongoing Investment Management, Rebalancing, Tax-Loss & Gain Harvesting, Risk Management & Estate Plan Monitoring, and handing the inevitable changes in your life, goals, tax laws, and markets.

We review and update your plan’s progress as needed, ensuring you remain on track to your most important goals.

Outside of our semi-annual meetings, we are readily available to you should you need assistance and financial council with major life changes or impactful decisions that need to be made.

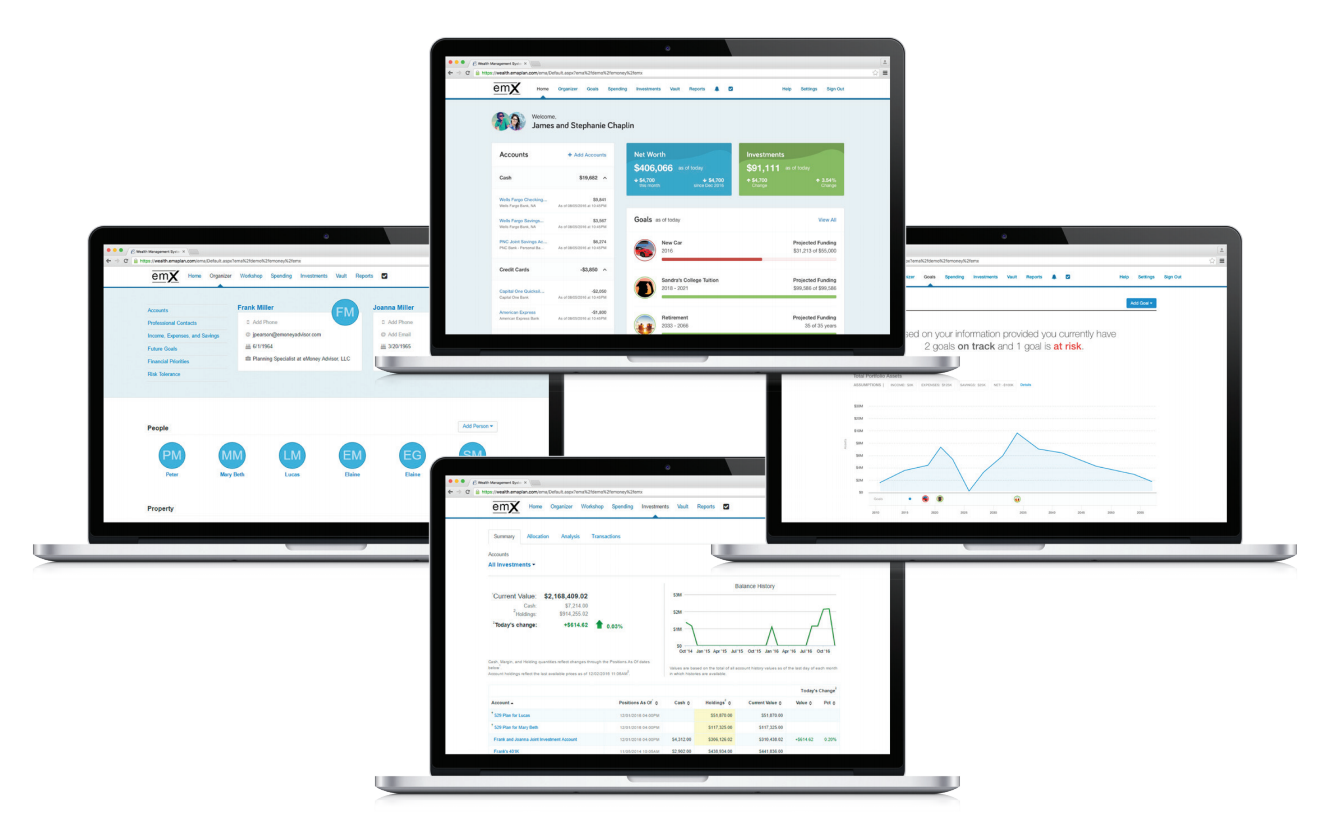

Your Financial Dashboard

You will have access to your own Financial Dashboard through state of the art financial planning software.

The Financial Dashboard will serve as a clear and complete picture of your financial life. When you link your accounts they update on a daily basis allowing you to see your current net worth, review your investment holdings, and see the details of your cash flow.